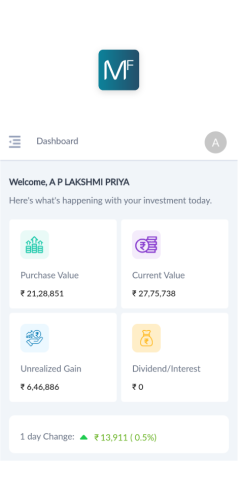

We are Midas Financial, a Mutual Fund Distribution Company, dedicated to tackling challenges in distributing mutual fund schemes through innovative technology and design strategies.

Our mission is to empower investors to make informed decisions, providing access to professionally managed mutual fund schemes to meet their financial objectives. Since 2010, our web application has simplified financial management, offering investors a user-friendly platform to navigate their investments with ease.

Investing in mutual funds are a good choice among investors because they generally offer the following features:

Professional Management:

The professional fund managers will do the research for you. They select the securities and monitor the performance in line with the investment objective of the fund.

Diversification:

Mutual funds typically invest in a range of companies and industries. This helps to reduce your risk if one company doesn’t perform. Simply it follows a principle, “Don’t put all your eggs in one basket.”

Affordability:

It helps investors to invest even with a small investment as little as Rs.500.

Liquidity:

Mutual fund investors can easily redeem their funds at any time.

There are different categories of mutual funds that offer different options to suit investors’ diverse risk appetites. Let us understand the different categories of mutual funds currently available in the market to help you make an informed investment decision.

Some common categories of mutual funds are:

Equity Schemes

Funds that invest only in stocks and other equity instruments, which aim to provide capital appreciation over the medium and long term. They have comparatively high risks.

Debt Schemes

The objectives of Debt funds is to provide regular and steady income to investors. Such funds generally invest in fixed income securities such as bonds, corporate debentures, government securities and money market instruments. Such funds are less risky compared to equity schemes.

Hybrid Schemes

Funds that divide investments between equity and debt to create a balance. (A Combination of the above two)

Solution Oriented Schemes

Funds that invest for the specific need of saving for children and for the purpose of retirement savings.

Other Schemes

Funds that invest in specific nature like Index, Global etc.

It is a trust that collects money from many investors and the money can be invested in stocks, bonds, money market instruments, gold, and other similar assets. The combined securities and assets the mutual fund own’s are known as its portfolio, which is managed by the fund manager.

Each investor will be allotted units based on the amount invested, which represents a portion of the portfolio holdings of the fund. The income or gains generated from this collective investment is distributed proportionately amongst the investors after deducting certain expenses, by calculating a scheme’s “Net Asset Value or NAV.

Let us look at a few important factors to keep in mind when selecting a mutual fund:

-Pedigree of the fund house

When you invest in a mutual fund, you are trusting the fund house to manage your money. This is why the pedigree of the fund is important. Decisions taken by the fund house and the fund manager may have a direct impact on your investment's performance and the realization of your financial goals. Hence, it is important to do a check on the fund house, history of existence, track record across schemes before selecting a scheme.

Consistency in past performance

Before you choose a scheme, check how the scheme compares with others on the stated benchmarks. Do not select funds only based on their performance over a 6-month to 1-year period. Instead, choose funds that have performed consistently and given steady returns over 3, 5 or 10 years by beating their benchmarks. Funds that have not just performed well when the markets are doing well, but the ones that remain steady even during a slump, are the ones to watch out for.

For example, let's say you have to choose between two funds A and B. Fund A gives more than 80% return in the first year due to a good bull run in the market, but witnesses a sharp decline in the NAV the next year due to volatile markets. On the other hand, Fund B has been giving consistent returns over a three-year period. Which one would you choose?

While past performance is no measure or guarantee for future returns, a fund house giving consistent returns denotes efficient processes and sound management practices. In the above example, Fund B may be a better choice with the fund house demonstrating efficiency, risk measures and sound investment processes.

Investment strategy and objectives

You should read the scheme related documents thoroughly and understand the investment objective (which is nothing but the investment goal and the underlying rationale e.g. growth, income) of the mutual fund scheme and know the kind of securities in which your money will be invested. Evaluate the objectives and see if they are in line with your risk profile and investment goals.

Diversification

Mutual funds, by their character themselves, provide diversification across stocks, sectors, and asset classes. Thus, you can use mutual funds to diversify your portfolio adequately. When you are investing in equity schemes, choose from top performing diversified equity schemes. Ensure that there is good spread of large-cap and mid-cap stocks in such schemes, and the fund has been consistent in performance for a minimum of three years. On the other hand, when you are choosing a debt fund, the first thing to do is to choose a fund that matches your investment horizon. Along with that you will have to consider the fund manager's view on the direction of interest rates and the sensitivity of your fund towards interest rate movement. The idea of diversification is to ensure that your risks are well spread across asset classes, market sectors and the style of fund management.

Goals and their time horizon

Mutual fund schemes must be chosen carefully in accordance with one's goals, time horizon, risk tolerance and overall financial plan. In fact, based on these parameters every investor must follow an asset allocation plan. Once you know how much you need to invest across different asset classes such as equity and debt, you must choose funds that match your tenure. If your goal is less than three years away, you should consider investing in a debt-oriented fund. For a medium-term goal that is typically between 3 - 5 years, you can consider hybrid equity funds that have exposure to both equity and debt. For long-term goals, equity mutual funds offer a good option.

Keeping the above factors in mind, you can choose a mutual fund scheme that is right for you and participate in the capital markets to reap the benefits of good returns.

We believe anyone can become an investor by taking two simple steps.

First, develop investment habits. Invest your extra cash, be it 500, 5000 or 50000, every month. Your small investment should grow larger over time.

Second, make smarter investment decisions by leveraging our extensive investment knowledge, in-depth market insights and exceptional investing instinct.

One can invest in mutual funds by submitting a duly completed application form along with a cheque or bank draft at the branch office or designated Investor Service Centre (ISC) of mutual Funds or Registrar & Transfer Agents of the respective the mutual funds.

One may also choose to invest online through our websites of the respective mutual funds.

The answer to this question would depend on your goals.

Every individual has goals. Ajay may want to buy a car. Danny and Joy may want to buy a home. Tameem may want to create an education fund for his child. Rupali and Sanjay may want to save for their daughter’s wedding. Raman may want to save retirement. Most likely, you probably have a combination of goals that you want to achieve.

To ensure you have the money to achieve your goals at the right time, you need to identify investment options that align with your goals’ timeframe.

For example, let’s assume you are investing to buy a Car in 3 years. If you invest in a long-term fund with a lock-in period of 5+ years, you will not be able to utilize these funds without incurring a penalty if any. To accomplish your goal within your timeframe, you should consider investing in a short-term fund.

Similarly, if you are looking to build an education fund for your child who is just 5 years old, you should consider investing in a long-term fund and take advantage of time.

Depending on the goals and the risk you can take, identify, and then evaluate Mutual Funds.

Before investing in a mutual fund scheme, read the Fund Fact Sheet. It is a basic one-page document that gives an overview of a mutual fund scheme with special emphasis on disclosure of scheme performance and portfolio and is published every month by each mutual fund. It is like a report card that indicates the health of the scheme.

It's a great starting point when one is evaluating a mutual fund scheme before investment. For potential investors, this is a necessary and easy document to read before investing. And it is very handy for those who have already invested, to keep track of their fund’s performance.

You can find the fact sheet on the mutual fund’s website. You can also call and request a copy to be mailed to you.

Finally make sure to fill in your personal details, bank details, nominee details and the suitable scheme to avoid any hassles in future.

Mutual funds offer one of the most comprehensive, easy, and flexible ways to create a diversified portfolio of investments. Broadly, any mutual fund will either invest in equities, debt, or a mix of both. Further, they can be open-ended or close-ended mutual fund schemes.

Open-ended funds: In an open-ended mutual fund, an investor can invest or enter and redeem or exit at any point of time. It does not have a fixed maturity period.

Close-ended funds: Close-ended mutual funds have a fixed maturity date. An investor can only invest or enter these types of schemes during the initial period known as the New Fund Offer or NFO period. His/her investment will automatically be redeemed on the maturity date. They are listed on stock exchange(s).

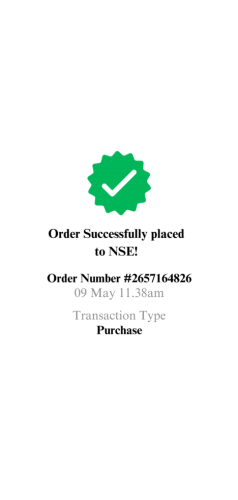

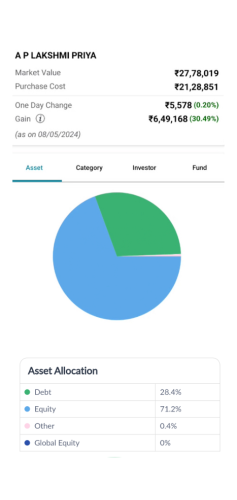

Once you buy a mutual fund scheme, you would get a statement to your registered email id and also through courier which will consist of the details such as your personal details, amount invested, current Net Asset Value (NAV), etc.

This statement is known as an account statement. You would not only receive the account statement after a few days of your investments, but also would receive the updated account statements on a periodic basis, thus the Mutual Fund house keeps you updated on your investments.

Verify the details mentioned in the application form are captured correctly by the mutual fund company. If not, please contact the fund house to rectify the same.

Consolidated Account Statement

Consolidated Account Statement (CAS) is a single/combined account statement which shows the details of financial transactions made by an investor during a month across all Mutual Funds and other securities held in dematerialized (Demat) mode.

CAS is issued for those folios / accounts wherein a financial transaction has been made during a month and wherein unit holders are identical, identified by Income Tax Permanent Account (PAN).

CAS is generated monthly in respect of the PANs common to the RTAs and the Depositories.

CAS for financial transactions done during each month are sent by the 10th of the following month.

Let's look at some of the common terms associated with mutual fund investments.

Common terms and concepts.

NFO:

NFO or New Fund Offer is the term given to a new fund offering for purchasing units of a mutual fund scheme by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

SIP:

A mutual fund gives you an option of either investing in a lump sum or through a Systematic Investment Plan or SIP, breaking the amount into periodic investments over a long period. For example, if Ravi wants to invest Rs 60,000 annually in a mutual fund scheme and doesn't have the lump sum amount available, he can opt for a SIP of Rs 5,000 every month.

NAV:

NAV or Net Asset Value is the price of each unit of a mutual fund. During the NFO, when the mutual fund scheme is introduced, it is priced at the face value - typically Rs 10. Later it may rise or fall depending on the performance of the fund. For example, if Ravi is investing Rs 60,000 as a lump sum during the NFO period, he will get 6000 units (Rs 60,000/Rs 10), each having an NAV of Rs 10.

Sales Price:

If the mutual fund scheme is an existing open-ended scheme, then the sales price is the price or NAV charged per unit for sale of units to the unit holder. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

Load:

Load is the fee charged (percentage of the NAV) by a mutual fund when you buy or sell units of a mutual fund. In India, presently there is no entry load when an investor buys mutual fund units. However, an exit load or a back-end load is applicable in some cases. It is the charge paid by an investor when he/she sells the units of a mutual fund before a specified period. It is deducted from the applicable NAV on redemption. It is generally levied to discourage early withdrawals. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

Repurchase price:

Repurchase price is the NAV minus the exit load (if applicable). by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

AUM:

Assets Under Management or AUM is the total value of all investments managed by the mutual fund. It can be at a scheme level or plan level. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

Portfolio:

Similarly, portfolio refers to all investments made by a mutual fund scheme and the amount held in cash. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

Expense ratio:

The expense ratio of a mutual fund is calculated by dividing the total expenses the fund has incurred by its AUM. It gives the cost a mutual fund incurs for managing each unit. A mutual fund deducts these expenses from the NAV before declaring it daily. The expense ratio is also disclosed once every six months in the scheme financials. It is also made available on the website of the mutual fund.

Redemption / Repurchase:

Redemption/Repurchase is the buying back or cancellation of units by a mutual fund. It can happen with maturity or on an on-going basis.

Switch:

An investor also has an option of switching or transferring his or her investment from one scheme to another scheme of the same fund house. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

STP:

An STP or Systematic Transfer Plan can be used in volatile markets to gradually transfer or switch small amounts of investments at chosen intervals (days/months/quarter) from one scheme to another scheme of a mutual fund. It is essentially used to transfer investments from one asset type to another.

SWP:

Many mutual funds provide the facility of Systematic Withdrawal Plans or SWPs whereby the investor receives a pre-determined amount on a periodic basis from the invested scheme. Investors who need regular income, like retirees, often go for this option. The payments are usually given from the fund's dividend income or capital gain distribution.

It is simple, the process of applying for withdrawal of money is known as redemption. You just need to log in the same way you invested online and submit the Redemption transaction.

The money will be credited to your registered bank account based on the scheme-specific turnaround time.

1. What is Sovereign Gold Bond (SGB)? Who is the issuer?

SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India.

Source: RBI

2. What is Gold Fund of Fund?

Gold Fund is an open-ended Fund of Fund (FOF) scheme that invests predominantly in the units of the underlying ETF Gold. The Scheme seeks to provide returns that closely correspond to returns provided by the underlying ETF Gold. You can invest in Gold Fund just like any other Mutual Fund Scheme without the hassles of opening a demat account, providing you an opportunity to take exposure into Gold as an asset class, in a convenient way.

3. What is an Exchange Traded Fund?

Exchange Traded Funds are mutual fund schemes in India listed on the stock exchanges and traded like common stock. The traded price of ETF units on the exchange reflects, before expenses, the value per unit of the underlying assets of the fund.

Invest systematically and regularly in mutual funds through SIPs to make the most of long-term investing for wealth creation with the help of equities.

There are various strategies adopted by the investors. Depending on their risk appetite, requirements and understanding of mutual funds, you may look out for investment strategies through various channels and through our website.

Past performance is not a reliable indicator of future performance, so don’t be excited by last year’s high returns. But past performance can help you assess a fund’s volatility over time.

Many banks now sell mutual funds, some of which carry the bank’s name. But mutual funds sold in banks, including money market funds, are not bank deposits.

Invest in Mutual Funds. Start Now

Invest in Mutual Funds. Start Now

We are Midas Financial, a AMFI registered mutual fund distributor promoted by a team of experienced finance professionals to help our clients invest seamlessly through innovative technology and design strategies.

Meet Our Founder & Managing Director Mr. Sathish Khumaar P an MBA by qualification has spent close to 25 years in the financial services Industry with various institutions such as ICICI Direct, HDFC Bank, & Reliance Capital, before laying foundation of Midas Financial in 2010.He visualized the growth of the Mutual fund and Financial Services sector through the power of technology at an early stage of his entrepreneurship journey.

Our mission is to empower investors to make informed decisions, providing access to professionally managed mutual fund schemes to meet their financial objectives. Since 2010, our web application has simplified financial management, offering investors a user-friendly platform to navigate their investments with ease.

Investing in mutual funds are a good choice among investors because they generally offer the following features:

Professional Management:

The professional fund managers will do the research for you. They select the securities and monitor the performance in line with the investment objective of the fund.

Diversification:

Mutual funds typically invest in a range of companies and industries. This helps to reduce your risk if one company doesn’t perform. Simply it follows a principle, “Don’t put all your eggs in one basket.”

Affordability:

It helps investors to invest even with a small investment as little as Rs.500.

Liquidity:

Mutual fund investors can easily redeem their funds at any time.

There are different categories of mutual funds that offer different options to suit investors’ diverse risk appetites. Let us understand the different categories of mutual funds currently available in the market to help you make an informed investment decision.

Some common categories of mutual funds are:

Equity Schemes

Funds that invest only in stocks and other equity instruments, which aim to provide capital appreciation over the medium and long term. They have comparatively high risks.

Debt Schemes

The objectives of Debt funds is to provide regular and steady income to investors. Such funds generally invest in fixed income securities such as bonds, corporate debentures, government securities and money market instruments. Such funds are less risky compared to equity schemes.

Hybrid Schemes

Funds that divide investments between equity and debt to create a balance. (A Combination of the above two)

Solution Oriented Schemes

Funds that invest for the specific need of saving for children and for the purpose of retirement savings.

Other Schemes

Funds that invest in specific nature like Index, Global etc.

It is a trust that collects money from many investors and the money can be invested in stocks, bonds, money market instruments, gold, and other similar assets. The combined securities and assets the mutual fund own’s are known as its portfolio, which is managed by the fund manager.

Each investor will be allotted units based on the amount invested, which represents a portion of the portfolio holdings of the fund. The income or gains generated from this collective investment is distributed proportionately amongst the investors after deducting certain expenses, by calculating a scheme’s “Net Asset Value or NAV.

Let us look at a few important factors to keep in mind when selecting a mutual fund:

-Pedigree of the fund house

When you invest in a mutual fund, you are trusting the fund house to manage your money. This is why the pedigree of the fund is important. Decisions taken by the fund house and the fund manager may have a direct impact on your investment's performance and the realization of your financial goals. Hence, it is important to do a check on the fund house, history of existence, track record across schemes before selecting a scheme.

Consistency in past performance

Before you choose a scheme, check how the scheme compares with others on the stated benchmarks. Do not select funds only based on their performance over a 6-month to 1-year period. Instead, choose funds that have performed consistently and given steady returns over 3, 5 or 10 years by beating their benchmarks. Funds that have not just performed well when the markets are doing well, but the ones that remain steady even during a slump, are the ones to watch out for.

For example, let's say you have to choose between two funds A and B. Fund A gives more than 80% return in the first year due to a good bull run in the market, but witnesses a sharp decline in the NAV the next year due to volatile markets. On the other hand, Fund B has been giving consistent returns over a three-year period. Which one would you choose?

While past performance is no measure or guarantee for future returns, a fund house giving consistent returns denotes efficient processes and sound management practices. In the above example, Fund B may be a better choice with the fund house demonstrating efficiency, risk measures and sound investment processes.

Investment strategy and objectives

You should read the scheme related documents thoroughly and understand the investment objective (which is nothing but the investment goal and the underlying rationale e.g. growth, income) of the mutual fund scheme and know the kind of securities in which your money will be invested. Evaluate the objectives and see if they are in line with your risk profile and investment goals.

Diversification

Mutual funds, by their character themselves, provide diversification across stocks, sectors, and asset classes. Thus, you can use mutual funds to diversify your portfolio adequately. When you are investing in equity schemes, choose from top performing diversified equity schemes. Ensure that there is good spread of large-cap and mid-cap stocks in such schemes, and the fund has been consistent in performance for a minimum of three years. On the other hand, when you are choosing a debt fund, the first thing to do is to choose a fund that matches your investment horizon. Along with that you will have to consider the fund manager's view on the direction of interest rates and the sensitivity of your fund towards interest rate movement. The idea of diversification is to ensure that your risks are well spread across asset classes, market sectors and the style of fund management.

Goals and their time horizon

Mutual fund schemes must be chosen carefully in accordance with one's goals, time horizon, risk tolerance and overall financial plan. In fact, based on these parameters every investor must follow an asset allocation plan. Once you know how much you need to invest across different asset classes such as equity and debt, you must choose funds that match your tenure. If your goal is less than three years away, you should consider investing in a debt-oriented fund. For a medium-term goal that is typically between 3 - 5 years, you can consider hybrid equity funds that have exposure to both equity and debt. For long-term goals, equity mutual funds offer a good option.

Keeping the above factors in mind, you can choose a mutual fund scheme that is right for you and participate in the capital markets to reap the benefits of good returns.

We believe anyone can become an investor by taking two simple steps.

First, develop investment habits. Invest your extra cash, be it 500, 5000 or 50000, every month. Your small investment should grow larger over time.

Second, make smarter investment decisions by leveraging our extensive investment knowledge, in-depth market insights and exceptional investing instinct.

One can invest in mutual funds by submitting a duly completed application form along with a cheque or bank draft at the branch office or designated Investor Service Centre (ISC) of mutual Funds or Registrar & Transfer Agents of the respective the mutual funds.

One may also choose to invest online through our websites of the respective mutual funds.

The answer to this question would depend on your goals.

Every individual has goals. Ajay may want to buy a car. Danny and Joy may want to buy a home. Tameem may want to create an education fund for his child. Rupali and Sanjay may want to save for their daughter’s wedding. Raman may want to save retirement. Most likely, you probably have a combination of goals that you want to achieve.

To ensure you have the money to achieve your goals at the right time, you need to identify investment options that align with your goals’ timeframe.

For example, let’s assume you are investing to buy a Car in 3 years. If you invest in a long-term fund with a lock-in period of 5+ years, you will not be able to utilize these funds without incurring a penalty if any. To accomplish your goal within your timeframe, you should consider investing in a short-term fund.

Similarly, if you are looking to build an education fund for your child who is just 5 years old, you should consider investing in a long-term fund and take advantage of time.

Depending on the goals and the risk you can take, identify, and then evaluate Mutual Funds.

Before investing in a mutual fund scheme, read the Fund Fact Sheet. It is a basic one-page document that gives an overview of a mutual fund scheme with special emphasis on disclosure of scheme performance and portfolio and is published every month by each mutual fund. It is like a report card that indicates the health of the scheme.

It's a great starting point when one is evaluating a mutual fund scheme before investment. For potential investors, this is a necessary and easy document to read before investing. And it is very handy for those who have already invested, to keep track of their fund’s performance.

You can find the fact sheet on the mutual fund’s website. You can also call and request a copy to be mailed to you.

Finally make sure to fill in your personal details, bank details, nominee details and the suitable scheme to avoid any hassles in future.

Mutual funds offer one of the most comprehensive, easy, and flexible ways to create a diversified portfolio of investments. Broadly, any mutual fund will either invest in equities, debt, or a mix of both. Further, they can be open-ended or close-ended mutual fund schemes.

Open-ended funds: In an open-ended mutual fund, an investor can invest or enter and redeem or exit at any point of time. It does not have a fixed maturity period.

Close-ended funds: Close-ended mutual funds have a fixed maturity date. An investor can only invest or enter these types of schemes during the initial period known as the New Fund Offer or NFO period. His/her investment will automatically be redeemed on the maturity date. They are listed on stock exchange(s).

Once you buy a mutual fund scheme, you would get a statement to your registered email id and also through courier which will consist of the details such as your personal details, amount invested, current Net Asset Value (NAV), etc.

This statement is known as an account statement. You would not only receive the account statement after a few days of your investments, but also would receive the updated account statements on a periodic basis, thus the Mutual Fund house keeps you updated on your investments.

Verify the details mentioned in the application form are captured correctly by the mutual fund company. If not, please contact the fund house to rectify the same.

Consolidated Account Statement

Consolidated Account Statement (CAS) is a single/combined account statement which shows the details of financial transactions made by an investor during a month across all Mutual Funds and other securities held in dematerialized (Demat) mode.

CAS is issued for those folios / accounts wherein a financial transaction has been made during a month and wherein unit holders are identical, identified by Income Tax Permanent Account (PAN).

CAS is generated monthly in respect of the PANs common to the RTAs and the Depositories.

CAS for financial transactions done during each month are sent by the 10th of the following month.

Let's look at some of the common terms associated with mutual fund investments.

Common terms and concepts.

NFO:

NFO or New Fund Offer is the term given to a new fund offering for purchasing units of a mutual fund scheme by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

SIP:

A mutual fund gives you an option of either investing in a lump sum or through a Systematic Investment Plan or SIP, breaking the amount into periodic investments over a long period. For example, if Ravi wants to invest Rs 60,000 annually in a mutual fund scheme and doesn't have the lump sum amount available, he can opt for a SIP of Rs 5,000 every month.

NAV:

NAV or Net Asset Value is the price of each unit of a mutual fund. During the NFO, when the mutual fund scheme is introduced, it is priced at the face value - typically Rs 10. Later it may rise or fall depending on the performance of the fund. For example, if Ravi is investing Rs 60,000 as a lump sum during the NFO period, he will get 6000 units (Rs 60,000/Rs 10), each having an NAV of Rs 10.

Sales Price:

If the mutual fund scheme is an existing open-ended scheme, then the sales price is the price or NAV charged per unit for sale of units to the unit holder. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

Load:

Load is the fee charged (percentage of the NAV) by a mutual fund when you buy or sell units of a mutual fund. In India, presently there is no entry load when an investor buys mutual fund units. However, an exit load or a back-end load is applicable in some cases. It is the charge paid by an investor when he/she sells the units of a mutual fund before a specified period. It is deducted from the applicable NAV on redemption. It is generally levied to discourage early withdrawals. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

Repurchase price:

Repurchase price is the NAV minus the exit load (if applicable). by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

AUM:

Assets Under Management or AUM is the total value of all investments managed by the mutual fund. It can be at a scheme level or plan level. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

Portfolio:

Similarly, portfolio refers to all investments made by a mutual fund scheme and the amount held in cash. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

Expense ratio:

The expense ratio of a mutual fund is calculated by dividing the total expenses the fund has incurred by its AUM. It gives the cost a mutual fund incurs for managing each unit. A mutual fund deducts these expenses from the NAV before declaring it daily. The expense ratio is also disclosed once every six months in the scheme financials. It is also made available on the website of the mutual fund.

Redemption / Repurchase:

Redemption/Repurchase is the buying back or cancellation of units by a mutual fund. It can happen with maturity or on an on-going basis.

Switch:

An investor also has an option of switching or transferring his or her investment from one scheme to another scheme of the same fund house. by an AMC. For closed-ended schemes, the NFO period is the only period for starting an investment.

STP:

An STP or Systematic Transfer Plan can be used in volatile markets to gradually transfer or switch small amounts of investments at chosen intervals (days/months/quarter) from one scheme to another scheme of a mutual fund. It is essentially used to transfer investments from one asset type to another.

SWP:

Many mutual funds provide the facility of Systematic Withdrawal Plans or SWPs whereby the investor receives a pre-determined amount on a periodic basis from the invested scheme. Investors who need regular income, like retirees, often go for this option. The payments are usually given from the fund's dividend income or capital gain distribution.

It is simple, the process of applying for withdrawal of money is known as redemption. You just need to log in the same way you invested online and submit the Redemption transaction.

The money will be credited to your registered bank account based on the scheme-specific turnaround time.

1. What is Sovereign Gold Bond (SGB)? Who is the issuer?

SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India.

Source: RBI

2. What is Gold Fund of Fund?

Gold Fund is an open-ended Fund of Fund (FOF) scheme that invests predominantly in the units of the underlying ETF Gold. The Scheme seeks to provide returns that closely correspond to returns provided by the underlying ETF Gold. You can invest in Gold Fund just like any other Mutual Fund Scheme without the hassles of opening a demat account, providing you an opportunity to take exposure into Gold as an asset class, in a convenient way.

3. What is an Exchange Traded Fund?

Exchange Traded Funds are mutual fund schemes in India listed on the stock exchanges and traded like common stock. The traded price of ETF units on the exchange reflects, before expenses, the value per unit of the underlying assets of the fund.

Invest systematically and regularly in mutual funds through SIPs to make the most of long-term investing for wealth creation with the help of equities.

There are various strategies adopted by the investors. Depending on their risk appetite, requirements and understanding of mutual funds, you may look out for investment strategies through various channels and through our website.

Past performance is not a reliable indicator of future performance, so don’t be excited by last year’s high returns. But past performance can help you assess a fund’s volatility over time.

Many banks now sell mutual funds, some of which carry the bank’s name. But mutual funds sold in banks, including money market funds, are not bank deposits.